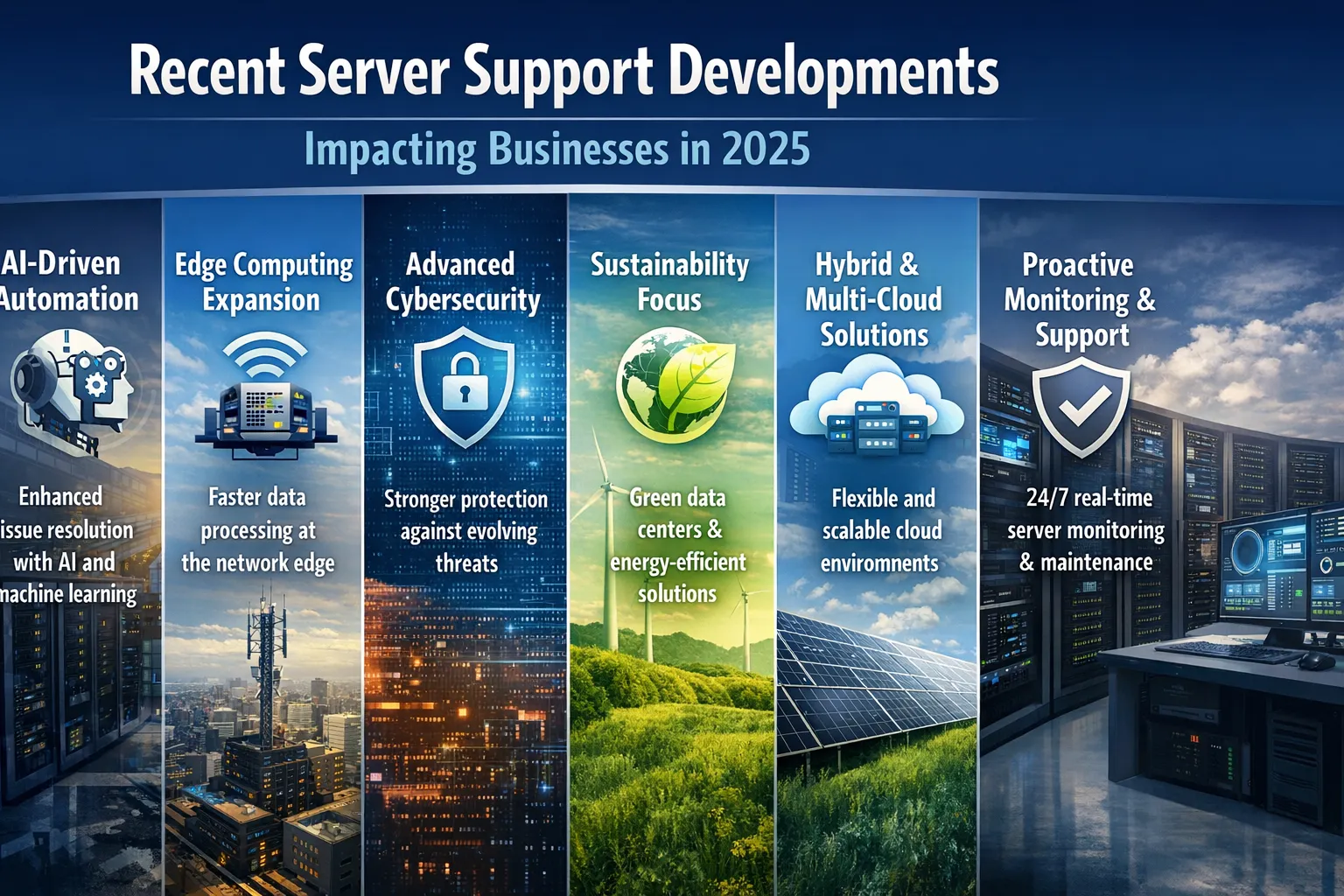

Recent Server Support Developments Impacting Businesses in 2025

The server infrastructure landscape is undergoing a profound transformation in 2025, driven by artificial intelligence demands, cloud evolution, and edge computing expansion. For businesses navigating digital transformation, understanding these developments is crucial for maintaining competitive advantage and operational efficiency. From Windows Server 2025’s revolutionary features to the explosive growth of AI-optimized infrastructure, the server support ecosystem is reshaping how organizations process data, deploy applications, and manage their IT operations.

The Windows Server 2025 Revolution

Microsoft’s launch of Windows Server 2025 in November 2024 has introduced significant advancements that are transforming enterprise infrastructure. The new version integrates Azure Arc with Windows Admin Center, providing a unified management experience for Windows Server instances across on-premises, cloud, and edge environments. This unified approach addresses one of the most persistent challenges in hybrid IT management.

The security enhancements in Windows Server 2025 represent a major leap forward. The platform includes multi-layered encryption protocols and real-time threat analysis using AI, responding directly to the escalating cyber threat landscape businesses face today. These features are particularly critical for industries like healthcare and finance where data protection is paramount.

Performance improvements are equally impressive. NVMe storage shows a 60% improvement in IOPs, while Hyper-V enhancements allow VMs to scale up to 240 terabytes of memory and 2,048 virtual processors. These specifications enable businesses to handle increasingly demanding workloads without compromising performance or requiring frequent hardware refreshes.

Perhaps most significantly for modern enterprises, Windows Server 2025 introduces flexible licensing models. Organizations can now choose between traditional perpetual licenses with ten years of support or subscription-based pay-as-you-go options through Azure Arc. This flexibility allows businesses to align infrastructure costs more closely with actual usage patterns, particularly beneficial for seasonal operations or fluctuating workloads.

The AI Infrastructure Explosion

The artificial intelligence boom has created unprecedented demand for specialized server infrastructure. The global AI server market was valued at $142.88 billion in 2024 and is projected to reach $837.83 billion by 2030, growing at a CAGR of 34.3%. This explosive growth reflects the reality that AI applications require fundamentally different computing architectures than traditional workloads.

GPU-based servers dominate this landscape due to their ability to handle massive parallel processing requirements. Cloud service providers are making massive capital investments to meet this demand. Microsoft plans to reach $80 billion in CapEx by 2025FY, focusing on expanding AI data centers, chips, and models. Similarly, Alphabet is increasing its CapEx from 52.5 billion dollars in 2024 to 75 billion dollars this year, accelerating investments in data centers and AI chips.

These investments aren’t limited to hyperscalers. According to research, increased spending is expected across all major technologies that form the foundation of AI infrastructure, with organizations planning to increase average spending for servers by 20% over the next 12 months. This spending reflects a broader recognition that AI infrastructure is becoming essential rather than optional for competitive businesses.

However, the transition to AI-optimized infrastructure presents challenges. Organizations must navigate supply chain complexities, manage significantly higher power and cooling requirements, and develop new operational expertise. The infrastructure that powered the past decade wasn’t designed for the relentless, context-hungry demands of AI agents and large language models.

Edge Computing’s Rise to Prominence

Edge computing has transitioned from emerging technology to business necessity in 2025. Gartner predicts 75% of enterprise data will be processed at the edge by 2025, compared to just 10% in 2018. This dramatic shift reflects fundamental changes in how businesses operate and the types of applications they deploy.

The proliferation of IoT devices drives much of this growth. With connected devices expected to reach 75 billion globally, processing all this data centrally becomes impractical and cost-prohibitive. Edge computing addresses this by processing data where it’s generated, dramatically reducing latency and bandwidth costs.

Latency improvements are particularly dramatic. Edge computing reduces latency to under 5 milliseconds, compared to the 20-40 milliseconds typical of cloud computing. For applications like autonomous vehicles, industrial automation, and real-time analytics, these milliseconds can mean the difference between success and failure.

The market is responding with substantial growth. The global edge computing market size is estimated at $168.40 billion in 2025 and is expected to reach $248.96 billion by 2030, growing at a CAGR of 8.1%. Asia Pacific leads this growth with an expected CAGR of 10.5%, driven by dense urban populations and aggressive smart city programs.

Industries are deploying edge computing for diverse applications. Retailers use it for real-time customer analytics and inventory management. Healthcare providers process diagnostic data locally for faster patient care. Manufacturing facilities leverage edge computing for predictive maintenance and quality control. These implementations demonstrate edge computing’s versatility across vertical markets.

Server Hardware and Cooling Innovations

The physical infrastructure supporting servers is evolving rapidly to meet new demands. Traditional air cooling is increasingly insufficient for high-density AI server deployments. Liquid cooling technologies are becoming increasingly necessary as servers generate more heat, not only reducing energy consumption but also improving the performance of high-density servers.

Research indicates the liquid cooling market for data centers will experience significant growth. The global liquid cooling market for data centers is estimated to reach $2.5 billion by 2025, growing at a compound annual growth rate of 26%. This growth is driven by high-performance computing demands and increasing awareness of energy efficiency.

Beyond cooling, server architectures are diversifying. While x86 platforms still dominate with approximately 74% market share, ARM-based servers and specialized accelerators are gaining traction. GPU servers have become critical infrastructure components, particularly for AI workloads. Organizations are also exploring composable infrastructure that allows dynamic pooling of CPU, memory, and accelerators to optimize resource utilization.

Hardware vendors are introducing innovative solutions. Dell launched the PowerEdge R760 designed specifically for high-demand AI and big data applications. Lenovo introduced the ThinkSystem SR6700, an AI-optimized server supporting deep learning applications. These specialized offerings reflect the market’s maturation and the recognition that one-size-fits-all servers no longer meet diverse workload requirements.

Hybrid Cloud and Management Complexity

The hybrid cloud model has become the de facto standard for enterprise IT, but managing these distributed environments presents significant challenges. Organizations must orchestrate workloads across on-premises data centers, multiple cloud providers, and edge locations while maintaining security, compliance, and performance.

Modern server support increasingly focuses on unified management platforms. Windows Server 2025’s Azure Arc integration exemplifies this trend, allowing administrators to manage servers regardless of location through a single interface. This unified approach reduces operational complexity and improves visibility across distributed infrastructure.

Containerization and orchestration technologies play crucial roles in hybrid environments. Containerized applications are becoming a cornerstone of scalable edge deployments, providing a lightweight, portable execution framework that allows enterprises to deliver applications consistently across sites with diverse hardware. This consistency is essential when managing thousands of distributed locations.

However, organizations face challenges beyond technology. Skills gaps persist, with IT teams needing expertise across traditional infrastructure, cloud platforms, edge computing, and increasingly, AI operations. This breadth of required knowledge creates talent shortages and drives demand for managed services.

Security and Compliance Evolution

Security considerations are paramount as server infrastructure becomes more distributed and handles increasingly sensitive data. The expanded attack surface created by edge computing, IoT devices, and hybrid cloud environments demands comprehensive security strategies.

Zero-trust architecture has emerged as the dominant security model. Rather than assuming trust based on network location, zero-trust requires verification for every access attempt. Windows Server 2025 implements zero-trust architecture, reducing vulnerabilities by treating every access attempt as untrusted until verified.

Data sovereignty regulations add another layer of complexity. Organizations must ensure data processing complies with regional requirements, which often necessitates local data processing capabilities. Edge computing helps address these requirements by enabling organizations to process sensitive data within geographic boundaries while still leveraging global infrastructure for non-sensitive workloads.

Automated security updates and patch management have become essential. Modern server platforms incorporate these capabilities, reducing the window of vulnerability and minimizing the operational burden on IT teams. However, organizations must balance security updates with application compatibility and uptime requirements, particularly for mission-critical systems.

The Enterprise Server Market Dynamics

The broader server market reflects these technological shifts. The global server market size was valued at $106.68 billion in 2024 and is poised to grow to $237.5 billion by 2033, growing at a CAGR of 9.3%. This growth is driven by digital transformation initiatives across industries and the ongoing need to modernize aging infrastructure.

Market competition remains intense. Dell Technologies, HPE, and IBM lead the traditional server market, while newer players like Lenovo and Supermicro expand with competitive pricing and specialized offerings. Meanwhile, hyperscalers like AWS, Google, and Microsoft dominate cloud infrastructure, creating a complex ecosystem where traditional vendors must compete and cooperate simultaneously.

Infrastructure refresh cycles accelerate as organizations recognize that delaying modernization creates competitive disadvantages. Approximately 60% of infrastructure spending is driven by refresh cycles, as organizations replace aging systems with more efficient, capable platforms that can support modern workloads including AI and edge computing.

Supply chain considerations continue influencing server acquisition decisions. Recent years have highlighted vulnerabilities in global supply chains, leading organizations to diversify suppliers and maintain larger inventory buffers. Component shortages, particularly for GPUs and specialized processors, can significantly impact deployment timelines and costs.

Emerging Technologies and Future Directions

Looking beyond 2025, several emerging technologies will shape server infrastructure evolution. Quantum-resistant networking is gaining attention as quantum computing advances threaten current encryption methods. Forward-thinking organizations are beginning to implement quantum-resistant protocols to protect long-term data security.

Serverless computing continues maturing, allowing developers to build applications without managing underlying infrastructure. While not eliminating the need for servers, serverless abstracts infrastructure management, enabling organizations to focus on application logic rather than operations. This trend is particularly strong for event-driven workloads and microservices architectures.

AI-driven infrastructure management is becoming reality. Platforms now incorporate machine learning for predictive maintenance, automated optimization, and anomaly detection. These capabilities reduce downtime, improve performance, and allow IT teams to focus on strategic initiatives rather than routine maintenance.

Sustainability is increasingly influencing infrastructure decisions. Organizations face pressure from stakeholders, regulators, and customers to reduce environmental impact. Modern servers emphasize energy efficiency, and liquid cooling systems not only improve performance but also enable waste heat recovery for building climate control or other purposes.

Strategic Recommendations for Businesses

Organizations navigating these server support developments should consider several strategic imperatives. First, develop a comprehensive infrastructure strategy that addresses immediate needs while maintaining flexibility for emerging requirements. This strategy should encompass on-premises, cloud, and edge computing in an integrated framework.

Second, prioritize security throughout the infrastructure lifecycle. Implement zero-trust principles, automate security updates, and ensure compliance with relevant regulations. Security cannot be an afterthought in modern distributed environments.

Third, invest in team skills development. The breadth of knowledge required to manage modern infrastructure exceeds what most organizations can maintain in-house. Consider hybrid approaches combining internal expertise with managed services for specialized areas like AI infrastructure or edge computing.

Fourth, evaluate infrastructure acquisition models carefully. Traditional capital expenditure models may not provide the flexibility needed for rapidly changing requirements. Subscription-based models, pay-as-you-go licensing, and infrastructure-as-a-service offerings can better align costs with actual business needs.

Finally, maintain awareness of emerging technologies and market trends. The server infrastructure landscape evolves rapidly, and early adoption of relevant technologies can provide competitive advantages. However, balance innovation with stability, ensuring that new technologies truly address business needs rather than chasing trends.

Conclusion

The server support landscape in 2025 represents both tremendous opportunity and significant complexity for businesses. Windows Server 2025 provides powerful capabilities for hybrid environments, AI infrastructure demands are reshaping data center architecture, and edge computing has become essential for real-time applications. Organizations that successfully navigate these developments will be better positioned to compete in an increasingly digital economy.

Success requires more than technology adoption. It demands strategic thinking about how infrastructure supports business objectives, investment in team capabilities, and careful attention to security and compliance. The organizations that thrive will be those that view server infrastructure not as a cost center but as a strategic enabler of business innovation and growth.

As we progress through 2025 and beyond, the pace of change shows no signs of slowing. Artificial intelligence will continue driving infrastructure evolution, edge computing will expand into new use cases, and hybrid cloud models will become even more sophisticated. Businesses that remain agile, invest wisely, and maintain focus on their core objectives will find ample opportunity in this dynamic landscape.

Frequently Asked Questions (FAQ)

Q: What are the most significant new features in Windows Server 2025?

A: Windows Server 2025 introduces several game-changing features including enhanced Azure Arc integration for unified hybrid management, GPU partitioning support for AI workloads, improved Hyper-V virtualization with dynamic processor compatibility, flexible pay-as-you-go licensing options, and advanced security features like hardware-based protection and AI-powered threat detection. The platform also offers substantial performance improvements with 60% better NVMe storage IOPs and support for up to 240 terabytes of VM memory.

Q: Why is AI infrastructure so expensive, and is it worth the investment?

A: AI infrastructure costs are high due to specialized hardware requirements, particularly GPU-based servers which are significantly more expensive than traditional servers. Power and cooling requirements for AI workloads also exceed conventional infrastructure. However, for organizations seriously pursuing AI capabilities, the investment is increasingly necessary. The global AI server market is growing at 34.3% annually, and businesses that delay AI infrastructure investments risk falling behind competitors. The key is aligning AI infrastructure spending with clear business objectives and expected returns.

Q: How does edge computing differ from cloud computing, and when should businesses use each?

A: Edge computing processes data near its source, while cloud computing processes data in centralized data centers. Edge computing excels for applications requiring ultra-low latency (under 5 milliseconds), bandwidth optimization, or local data processing for regulatory compliance. It’s ideal for IoT devices, autonomous vehicles, real-time analytics, and situations with unreliable connectivity. Cloud computing remains optimal for applications that can tolerate higher latency, require massive scalability, or benefit from centralized data aggregation. Most modern businesses use hybrid approaches, combining both edge and cloud infrastructure.

Q: What security considerations are most important for modern server infrastructure?

A: Zero-trust architecture is the foundational security principle, verifying every access attempt regardless of source. Organizations should implement multi-layered encryption, automated patch management, and AI-powered threat detection. For distributed environments, secure remote access, consistent security policies across locations, and comprehensive monitoring are essential. Data sovereignty compliance requires careful attention to where data is processed and stored. Regular security assessments and incident response planning are critical, as are training programs to address the human element of security.

Q: How should businesses approach the transition from traditional servers to modern infrastructure?

A: Start with assessment: evaluate current infrastructure capabilities against business requirements and identify gaps. Develop a phased migration strategy rather than attempting wholesale replacement. Prioritize workloads based on business impact and technical feasibility. Consider hybrid approaches that integrate existing investments with new capabilities. Invest in team training or engage managed service providers for expertise gaps. For Windows Server users, the 2025 version offers compelling upgrade paths with improved hybrid management. Don’t neglect security and compliance during transitions. Finally, measure success against business outcomes, not just technical metrics.

Q: What is liquid cooling, and do all businesses need it?

A: Liquid cooling uses fluids rather than air to remove heat from servers. It’s becoming essential for high-density AI server deployments where traditional air cooling is insufficient. Direct liquid cooling can achieve efficiency ratings near 1.01 PuE (Power Usage Effectiveness) compared to 1.5-2.0 for air-cooled data centers. However, not all businesses need liquid cooling immediately. It’s most relevant for organizations deploying GPU-dense AI infrastructure, high-performance computing clusters, or operating in space-constrained environments. Traditional air cooling remains adequate for conventional server workloads.

Q: How can small and medium businesses benefit from these server developments?

A: SMBs can leverage these developments through cloud services and managed offerings rather than building infrastructure in-house. Major cloud providers offer AI capabilities, edge computing services, and the latest Windows Server versions on pay-as-you-go models, eliminating capital expenditure barriers. Managed service providers can deliver enterprise-grade capabilities at SMB-appropriate scale and cost. The key is focusing on business outcomes rather than infrastructure complexity. Many advanced capabilities that required large infrastructure investments are now accessible through service models, leveling the playing field for smaller organizations.

Q: What role does sustainability play in modern server infrastructure decisions?

A: Sustainability is increasingly important due to regulatory requirements, stakeholder pressure, and operational cost considerations. Modern servers emphasize energy efficiency, and technologies like liquid cooling enable waste heat recovery. Organizations are evaluating total environmental impact including manufacturing, operation, and disposal. Cloud providers achieve efficiency advantages through scale, making cloud migration a sustainability strategy for some organizations. However, edge computing can increase overall energy consumption if not carefully managed. Best practices include right-sizing infrastructure, implementing efficient cooling, using renewable energy where possible, and considering equipment lifecycle environmental impact.

Q: What skills should IT teams develop to manage modern server infrastructure?

A: Teams need a blend of traditional and emerging skills. Core infrastructure management remains important but must expand to include cloud platform expertise (Azure, AWS, Google Cloud), containerization and orchestration (Kubernetes, Docker), automation and infrastructure-as-code (Terraform, Ansible), security principles including zero-trust, and increasingly, AI/ML operations. Understanding hybrid cloud architecture and edge computing is essential. Soft skills like adaptability, continuous learning, and cross-functional collaboration are equally important as technology evolves rapidly. Organizations should provide training opportunities and consider hybrid staffing models combining internal teams with specialized external expertise.

Q: How are supply chain issues affecting server acquisition in 2025?

A: Supply chain challenges persist, particularly for specialized components like GPUs and custom processors essential for AI workloads. Lead times can extend several months for high-demand components. Organizations should plan infrastructure deployments with longer timelines, consider multiple vendor relationships to reduce dependency, and maintain inventory buffers for critical components. Working closely with vendors for forecast visibility helps manage expectations. Some organizations are exploring alternative architectures or cloud services to avoid supply chain constraints. The situation is improving compared to recent years but remains a consideration for infrastructure planning.

No comment